Taxes on 401k withdrawal calculator

New Look At Your Financial Strategy. Not an easy task.

Taxes On 401k Distribution H R Block

Understand What is RMD and Why You Should Care About It.

. That extra 6000 basically makes the calculation a no-brainer. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. If you are under 59 12 you may also be.

Lets go back to the 401k calculator. IRA and Roth IRA. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time.

In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of. Please visit our 401K Calculator for more information about 401ks. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

The Roth 401k contributions are not tax-deductible and you wont pay taxes on withdrawals in retirement. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. This amount doesnt include your pension or social. Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans.

In this case your withdrawal is subject to the. Visit The Official Edward Jones Site. Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The withdrawal amount translates to a monthly withdrawal amount of or a quarterly withdrawal amount of.

However if you make a withdrawal before reaching 59 ½ you will pay income taxes. Or of your investments. Using this 401k early withdrawal calculator is easy.

Build Your Future With a Firm that has 85 Years of Retirement Experience. We have the SARS tax rates tables. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

This is a very. 50 State income tax rate 0 7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The. Even without matching the 401k can still make financial sense because of its tax benefits.

Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. Ad Make a Thoughtful Decision For Your Retirement. Multiply the amount of your 401k plan withdrawal by your state income tax rate.

For example if your state tax rate equals 5 percent multiply 20000 by 005 to find you owe 1000. 25Years until you retire age 40 to age 65.

Retirement Withdrawal Calculator

Traditional Vs Roth Ira Calculator

Retirement Calculator Retirement Calculator Savings Calculator Retirement Financial Planning

Traditional Vs Roth Ira Calculator

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

What Is The 401 K Tax Rate For Withdrawals Smartasset

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result Tax Free Savings Start Up Business Retirement Planning

401k Calculator Withdrawal Clearance 55 Off Www Visitmontanejos Com

Who Should Make After Tax 401 K Contributions Smartasset

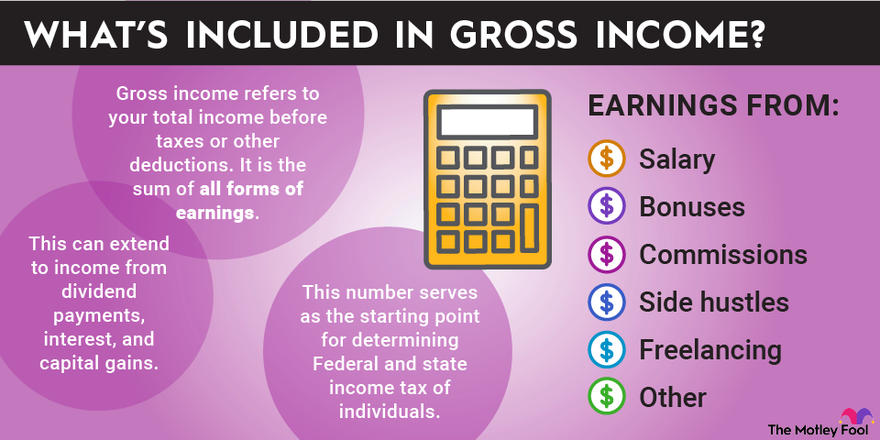

How To Calculate Gross Income Per Month

Free 401k Calculator For Excel Calculate Your 401k Savings

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401 K Early Withdrawal Guide Forbes Advisor

What Is The 401 K Tax Rate For Withdrawals Smartasset

Retirement Withdrawal Calculator For Excel

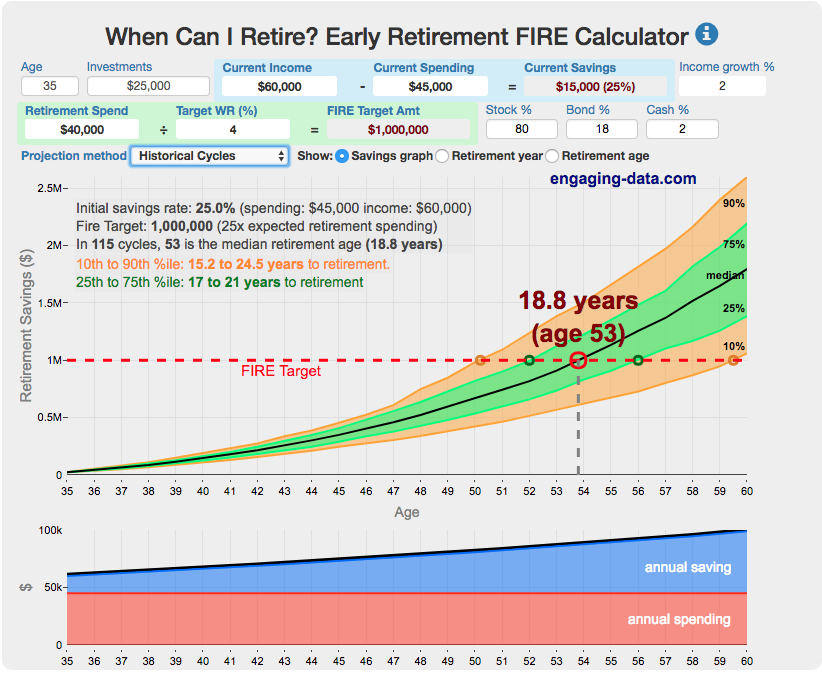

Fire Calculator When Can I Retire Early Engaging Data

How Much Will I Get If I Cash Out My 401 K Early Ubiquity